Instead Brexit side won and volatility increased. This will be a "chess" game and I don't think it will be over soon. I don't exclude new general elections in UK in 2017 if Parliament is not able to carry on with the Brexit proposal.

By the way, let's see the performances and analyze this first half of 2016.

This will be an important problem in the future, because they will be "forced" to go on more volatile assets, increasing volatility of models 1-2 returns and losing part of they prudent skill.

The Model 3 variants are more aggressive and can cope better with negative worlds, having more asset choices. But I fear their volatility will be higher than in the past too.

After these complains, let's write about something more juicy.

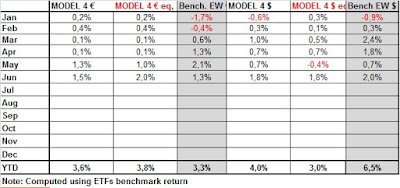

ALL models returns are positive year to date.

Models 4 are simple. Basically they try to beat an equal weighted portfolio. They usually tend to underperform in strong positive markets and overperform in bear markets.

Both European and US models are quite positive year to date. The 2 Europeans are beating benchmark at the moment, while the US are underperforming.

But I am satisfied. What I don't want to see is a benchmark very positive and models performance very negative.

SUMMARY: I am quite satisfied of 1H 2016 returns where many investors are licking their wounds.

I created this blog because it's quite easy to have impressive back-test results, but I liked to monitor models in real field. Of course there's no guarantee of positive returns in the future, but I think in the long term this models can help to surf the investing sea.

I repeat a answer I gave to a reader:

these are the returns of ETF benchmarks, therefore real investing retuns would be lower because bid/ask spread, ETF management fees, commission, slippage and, finally, tax issues. Performance are calculated supposing to invest at the close of the month.

It's important to note that, very often, the enter price is not the lowest price in the following month....this means that there's almost always the chance to buy ETF at a lower price than entry model price in the next month.

Don't know if I was clear. If closing price of benchamrk ETF X in May is 100, model enters at 100.

Almost ever, in the following month (June), the ETF will drop below 100 for at least 1-2 days somewhere in the month.

Entering when it drops, could help the investor to have a performance more in line with the model...:)

NOTE: this blog is not an investing consulting services, therefore if you follow signal I'm not responsible for eventual losses. I'd be glad to receive just a thank you if you earn :)