Saturday, May 9, 2015

may allocation follow up

This morning I updated the post I wrote last week end with table and further considerations

Monday, May 4, 2015

May Allocation - preliminary

I am quite busy at the moment.

I couldn't update in the week end because last week moves were "strong" and I needed to download data instead of doing a proxy for last month day like usual.

It was a "decimal game".

I'll write more in the week end. At the moment I just post the new allocation

Model 1: € government 1-3years (defensive)

Model 2: € High Yield

Model 3: € Inflation bonds + € High Yield

The models abandoned the € government 15-30 after the strong fall at the end of April

there were losses, but still in positive YTD.

keep in touch

______________________

Updated on 9 May

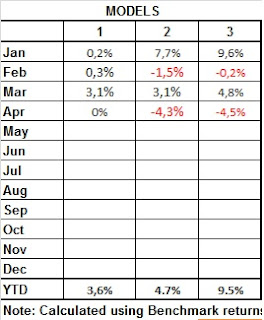

After a very busy week that showed a very strong volatility on Bonds markets, I'm going to update the table with performances.

May didn't start good for monthly allocations because both high yield and inflation bonds suffered from the huge stress in European market.

As I posted on Twitter, because of very high unusual moves and volumes, the probability of a short term bottom is very high.

But trend could be definitively changed this month and investors needs to be on alert on Bonds (especially in Europe) with stop losses in particular on the longer maturities.

By the way, these models don't have an "intra-monthly" stop built in them, but the stop is implicit at the end of the month if the allocation changes.

Let's see the performance in April that basically deleted the very good March's results. All models are in positive but 2 months ago i was happier.

I couldn't update in the week end because last week moves were "strong" and I needed to download data instead of doing a proxy for last month day like usual.

It was a "decimal game".

I'll write more in the week end. At the moment I just post the new allocation

Model 1: € government 1-3years (defensive)

Model 2: € High Yield

Model 3: € Inflation bonds + € High Yield

The models abandoned the € government 15-30 after the strong fall at the end of April

there were losses, but still in positive YTD.

keep in touch

______________________

Updated on 9 May

After a very busy week that showed a very strong volatility on Bonds markets, I'm going to update the table with performances.

May didn't start good for monthly allocations because both high yield and inflation bonds suffered from the huge stress in European market.

As I posted on Twitter, because of very high unusual moves and volumes, the probability of a short term bottom is very high.

But trend could be definitively changed this month and investors needs to be on alert on Bonds (especially in Europe) with stop losses in particular on the longer maturities.

By the way, these models don't have an "intra-monthly" stop built in them, but the stop is implicit at the end of the month if the allocation changes.

Let's see the performance in April that basically deleted the very good March's results. All models are in positive but 2 months ago i was happier.

Subscribe to:

Posts (Atom)