Tuesday, June 14, 2016

May performance

May was a tough month with model 3 suffering some reversal in assets.

Model 1-2 defended themselves being allocated on euro high yield.

On the other side, the super-diversified models 4 had a good month, even if they lagged their benchmarks. But it's built to give a better risk/reward rather than beat benchmark on absolute terms.

June is going to be a tough month as well, with abrupt moves caused by Brexit.

It ise an high volatility environment. In the last 2 days, euro high yield suffered a lot.

On the other side euro govies (core) are rallying with Bund 10y below 0% for the first time.

Dollar is rallying as well, together with Japanese yen, while European stocks crashed. Sterling is suffering as well, as Brexit -side is increasing support according to polls.

At the end of the month it could be a different story, if Brexit dosn't materialize, but what is sure is that with a zero-negative bond rates worldwide, is very difficult to have a good asset allocation.

"Thank you" Mario again...

i want to see how insurances and pension funds will be able in the future to offer decent returns...

NIRP is an extra-tax on our savings.

PS: don't know if in July, my models will allocate on euro bonds, but eventually, I won't invest in that signal . I can't accept to pay a government that borrows my money...

Thursday, June 2, 2016

June Allocations

Here the allocations for June.

The safest models continue to allocate in Euro HY because of the crazy NIRP World...

Gold exited from portfolios after the recent weakness and S&P500 replaces it

New names appeared in some models

The safest models continue to allocate in Euro HY because of the crazy NIRP World...

Gold exited from portfolios after the recent weakness and S&P500 replaces it

New names appeared in some models

Saturday, May 14, 2016

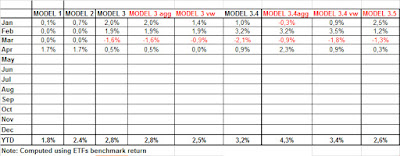

Performances year to date

Here I am, PC is back and so far it works. Instead Excel has problems with the license, because it see the old PC as a new one and doesn't work. So I am using a third party PC.

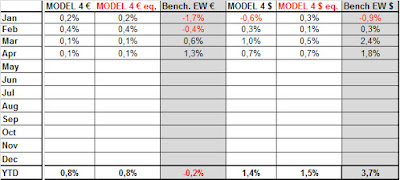

I am going to post the performances for the first 4 months.

The good news is that all models are positive year to date, with April that was a good month (especially for safer models), while March was basically a bad one.

So far May isn't very good, because models increased exposure to euro high yield bonds that are suffering since 3 weeks. But so far the gain of previous month are higher (especially in model 1 & 2 that are the most defensive and where allocation of capital is higher).

Model 4 is beating the equal weighted benchmark in Europe, but not in US.

Unfortunately we are witnessing the "side-effect" of NIRP world (Negative Interest Rate Policy).

With short term bond negative, unless all assets become "funny", we are likely to see Model 1&2 going more on higher volatile assets. These are the most defensive models, designed to be low volatile. Is very likely that future model returns will be more volatile than the past and I don't like that at all...

"Thank you very much" Mario & Kuroda... "I love you"...

But this is what markets offers now. Probably in the future the most important thing will be wealth preservation rather than making money, because with NIRP is likely that average future returns will be lower than in the past for almost every asset.

I am still planning to build the "Big model" with the engine of model 3 plus many more asset classes (I'm thinking about 50 or 60). It takes time to do that and my time is not much at the moment, but I'll try to finish it within end of year. I want it ready before the next crisis. My aim is to build a version more defensive, one more aggressive and one with changing weighs.

OF course these models aren't perfect. I am not able to do that. I could have had best backtest returns with iper-hoptimization, but is not my scope. I think that KISS is the best thing (Keep it simple stupid) and the work that gives higher chances that in real a model will work. In the future it will be important to have a Compass for difficult financial moments.

I repeat a note, in real these returns will be lower because of transaction costs, ETF managements fees and taxes. Consider this issue.

I am going to post the performances for the first 4 months.

The good news is that all models are positive year to date, with April that was a good month (especially for safer models), while March was basically a bad one.

So far May isn't very good, because models increased exposure to euro high yield bonds that are suffering since 3 weeks. But so far the gain of previous month are higher (especially in model 1 & 2 that are the most defensive and where allocation of capital is higher).

Model 4 is beating the equal weighted benchmark in Europe, but not in US.

Unfortunately we are witnessing the "side-effect" of NIRP world (Negative Interest Rate Policy).

With short term bond negative, unless all assets become "funny", we are likely to see Model 1&2 going more on higher volatile assets. These are the most defensive models, designed to be low volatile. Is very likely that future model returns will be more volatile than the past and I don't like that at all...

"Thank you very much" Mario & Kuroda... "I love you"...

But this is what markets offers now. Probably in the future the most important thing will be wealth preservation rather than making money, because with NIRP is likely that average future returns will be lower than in the past for almost every asset.

I am still planning to build the "Big model" with the engine of model 3 plus many more asset classes (I'm thinking about 50 or 60). It takes time to do that and my time is not much at the moment, but I'll try to finish it within end of year. I want it ready before the next crisis. My aim is to build a version more defensive, one more aggressive and one with changing weighs.

OF course these models aren't perfect. I am not able to do that. I could have had best backtest returns with iper-hoptimization, but is not my scope. I think that KISS is the best thing (Keep it simple stupid) and the work that gives higher chances that in real a model will work. In the future it will be important to have a Compass for difficult financial moments.

I repeat a note, in real these returns will be lower because of transaction costs, ETF managements fees and taxes. Consider this issue.

Monday, May 2, 2016

Emergency May allocation

My pc continue to go & return from the tech office because they don't understand what is broken

I found an old pc for emergency but Excel version is quite old and I have troubles running my models.

By the way I was able to run them finally and I post an update of MAY ALLOCATION

Later in the month I'll post an update with the performances in the last 2 months.

I found an old pc for emergency but Excel version is quite old and I have troubles running my models.

By the way I was able to run them finally and I post an update of MAY ALLOCATION

Later in the month I'll post an update with the performances in the last 2 months.

Tuesday, April 12, 2016

Emergency April Allocation

My pc continues to be broken, but I calculated allocations using a pc from a friend of mine.

I'm going to post just "raw" allocations on the basics models and when I'll have my one (not before 10 days if I'm lucky) I'll post the full allocations for tracking history

MODEL 1 Euro High Yield 100%

MODEL 2 Euro High Yield 100%

MODEL 3 classic Gold 50% ---- Euro govies 15-30years 50%

MODEL 3.4 Gold 34% ----Euro govies 15-30years 33% - EM bonds local currency 33%

MODEL 4 € Euro govies 56% ----- Emerging Bonds $ 11% --- euro HY 11% ---- Eurobonds 11% ---- Developed market properties 11%

MODEL 4$ Treasury 1-3y 34% --- S&P500 11% ---- Emerging bonds $ 11% ----HY USA 11% ----- US Govies 11% ----Global bonds 11% ---- Developed markets properties 11%.

I wrote them down fast and did calculations quickly as well.

Hope there are not mistakes.

Bye bye

I'm going to post just "raw" allocations on the basics models and when I'll have my one (not before 10 days if I'm lucky) I'll post the full allocations for tracking history

MODEL 1 Euro High Yield 100%

MODEL 2 Euro High Yield 100%

MODEL 3 classic Gold 50% ---- Euro govies 15-30years 50%

MODEL 3.4 Gold 34% ----Euro govies 15-30years 33% - EM bonds local currency 33%

MODEL 4 € Euro govies 56% ----- Emerging Bonds $ 11% --- euro HY 11% ---- Eurobonds 11% ---- Developed market properties 11%

MODEL 4$ Treasury 1-3y 34% --- S&P500 11% ---- Emerging bonds $ 11% ----HY USA 11% ----- US Govies 11% ----Global bonds 11% ---- Developed markets properties 11%.

I wrote them down fast and did calculations quickly as well.

Hope there are not mistakes.

Bye bye

Tuesday, April 5, 2016

PC BROKE DOWN

this month I'll not be able to update allocations at the beginning of the month because of tech issues.

I'll post it later in the month for info purposes when I'll be able to reach a temporary pc.

I'll post it later in the month for info purposes when I'll be able to reach a temporary pc.

Saturday, March 12, 2016

February Performances

February was a quite good month with all models that recorded positive performances.

Model 1& 2 continue to stay defensive and could struggle over the year with this negative yield environment...Central Banks (ECB.....) is not helping....

Model 3 recorded a positive performance thanks to $ and yen exposure, as well good euro government bond environment.

Models 4 recorded a small positive gain and are overperforming their benchmark (it's quite common when stocks markets are weak).

March is going to be more difficult with an high dollar & bond volatility because of central banks action.

ECB used a nuclear weapon last week (it was unexpected for me the TLTRO with theoretically negative rates to banks...), let's see Fed what will say next week. I think the Fed will try to rise rates further in the year because they know that in the next recessions weapons will be exhausted.

ECB is already all in, signaling that situation on this side of the Ocean is quite bad...

Let's surf this market in 2016, but it will be an high volatility environment.

Model 1& 2 continue to stay defensive and could struggle over the year with this negative yield environment...Central Banks (ECB.....) is not helping....

Model 3 recorded a positive performance thanks to $ and yen exposure, as well good euro government bond environment.

Models 4 recorded a small positive gain and are overperforming their benchmark (it's quite common when stocks markets are weak).

March is going to be more difficult with an high dollar & bond volatility because of central banks action.

ECB used a nuclear weapon last week (it was unexpected for me the TLTRO with theoretically negative rates to banks...), let's see Fed what will say next week. I think the Fed will try to rise rates further in the year because they know that in the next recessions weapons will be exhausted.

ECB is already all in, signaling that situation on this side of the Ocean is quite bad...

Let's surf this market in 2016, but it will be an high volatility environment.

Subscribe to:

Posts (Atom)