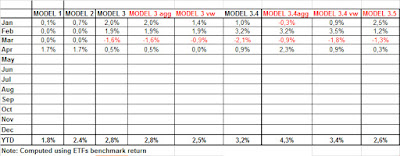

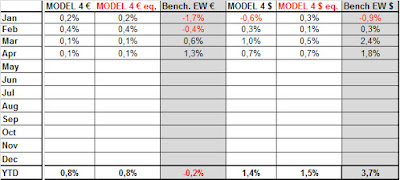

I am going to post the performances for the first 4 months.

The good news is that all models are positive year to date, with April that was a good month (especially for safer models), while March was basically a bad one.

So far May isn't very good, because models increased exposure to euro high yield bonds that are suffering since 3 weeks. But so far the gain of previous month are higher (especially in model 1 & 2 that are the most defensive and where allocation of capital is higher).

Model 4 is beating the equal weighted benchmark in Europe, but not in US.

Unfortunately we are witnessing the "side-effect" of NIRP world (Negative Interest Rate Policy).

With short term bond negative, unless all assets become "funny", we are likely to see Model 1&2 going more on higher volatile assets. These are the most defensive models, designed to be low volatile. Is very likely that future model returns will be more volatile than the past and I don't like that at all...

"Thank you very much" Mario & Kuroda... "I love you"...

But this is what markets offers now. Probably in the future the most important thing will be wealth preservation rather than making money, because with NIRP is likely that average future returns will be lower than in the past for almost every asset.

I am still planning to build the "Big model" with the engine of model 3 plus many more asset classes (I'm thinking about 50 or 60). It takes time to do that and my time is not much at the moment, but I'll try to finish it within end of year. I want it ready before the next crisis. My aim is to build a version more defensive, one more aggressive and one with changing weighs.

OF course these models aren't perfect. I am not able to do that. I could have had best backtest returns with iper-hoptimization, but is not my scope. I think that KISS is the best thing (Keep it simple stupid) and the work that gives higher chances that in real a model will work. In the future it will be important to have a Compass for difficult financial moments.

I repeat a note, in real these returns will be lower because of transaction costs, ETF managements fees and taxes. Consider this issue.

No comments:

Post a Comment